We help colleges provide affordable, accredited & regulated financial education to their students.

An introduction to Fel

Financial elearning

Fel provides a variety of affordable, regulated & accredited courses across a range of financial topics, in partnership with Stellar Education. These courses are provided through our no-cheat AI Assessment technology-based Learning Management System, creating the very best online learning environment for students.

Martin Hills – Founder & CEO

Martin Hills started his journey within the financial sector over 25 years ago & prior to setting up financial e-learning, Martin worked as a city trader in some of the worlds most prestigious financial institutions. Martin left the corporate world to pursue his purpose of creating a more financially literate world, Fel was born.

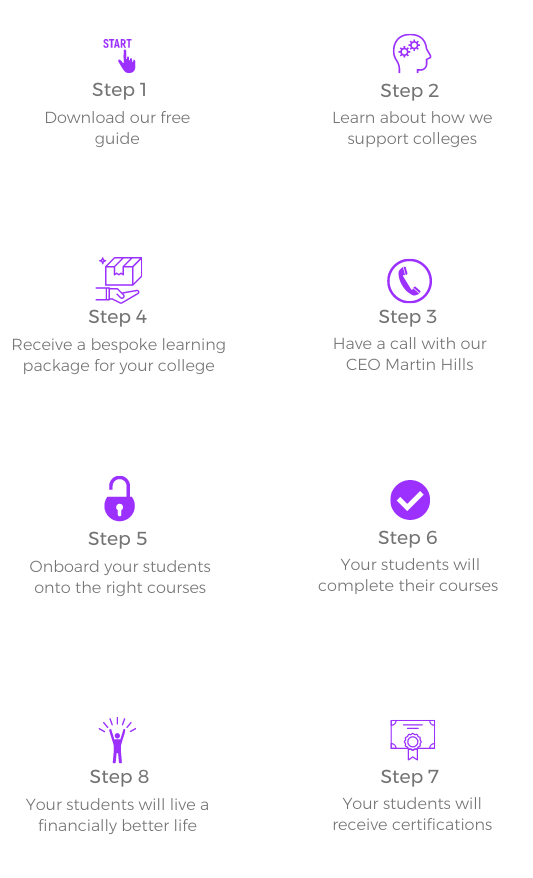

How FeL works with colleges

Our regulated & accredited courses

Here at Fel, we have a range of leading regulated & accredited financial e-learning courses available.

Level 1 Award – Managing Your Own Money

The range of units contained in this qualification allow you to learn, develop and practice the financial skills required for life and has been designed to meet the needs of learners who wish to gain an understanding of how to balance income and expenditure, how to save money and SAFE borrowing.

Level 1 Certificate – Managing Personal Finance

This course has been designed to meet the needs of learners who wish to comprehend the principles of saving and borrowing money, sources of income and expenditure, the importance of budgeting, and financial products and services available.

.

Level 1 Award – Ways to Maintain Personal Well-Being

This qualification has been developed to make learners aware of the principles of personal well-being and ways of maintaining it. It explores the impact of positive behaviour, healthy-eating, mindfulness and meditation. The modules within the course also covers the importance of physical activities, connections to peers, and generosity and support to others.

Our previous work with colleges

Since late last year, we have been working closely with USP college Seevic in Thundersley, Essex.

One of their Higher Education Team members, Olivia Suleman, had been in discussion with their students regarding financial education, their main difficulty was the lack of enough qualifications on the curriculum.

Seevic recognised there was also a lack of understanding regarding personal finance for a large number of their students. In order to fill this gap, our level 1&2 awards and certificates on this topic are exactly what was needed.

Currently, we are putting together a package for SEVIC to cover the issue of personal finance as well as the option of using our level 3 certificate in trading to ensure their students are fully prepared before diving into the world of financial trading.

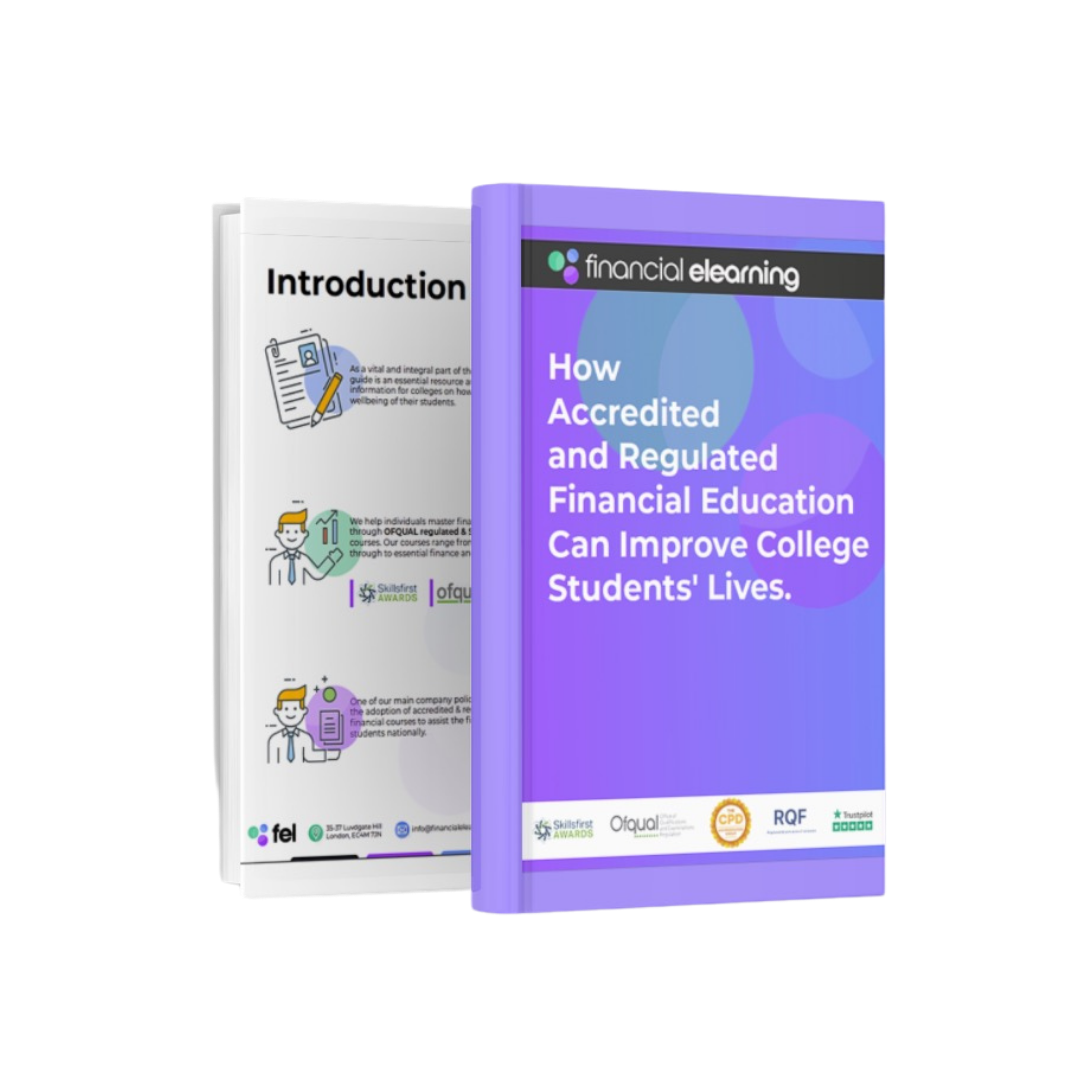

FREE GUIDE: Learn more about how we support Colleges

How Accredited & Regulated Financial Education Can Improve College Students Lives.

What you’ll learn:

- How financial education can improve the lives of college students

- Why financial education can provide extremely important life skills to students

- How college students can access financial education requiring little effort from the colleges

- How easy it is to improve the financial well being of college students

- The exact courses college students require in order to become financially literate

What our clients say about us…

Ray Otto

"Financial eLearning has been instrumental in developing our staff's understanding of the global financial markets by creating an amazing bespoke learning package for us. We spoke with Martin, FeL’s director whose awareness and grasp of our requirements combined with his vast knowledge and experience of the financial markets and passion for education has made this a seamless and enjoyable experience"

Harry Daniels

"In an overcrowded space, Financial eLearning stands head and shoulders above its peers to provide a comprehensive and unique experience for its students through its bespoke offerings. The breadth and depth of the available courses can only come from industry experience and ‘know-how’ obtained from years working in and around financial products. Combine these attributes with the desire and determination to help educate and you have the complete package"

Lucius Freud

"I recently did the course on how to maintain personal well-being. I found the course very helpful and learnt a lot about the different types of ways our wellbeing can be maintained. The platform was easy to use and had clear information on what to do. Thank you."

Stacey Robertson

"I have attended more than half a dozen trading training courses over the last four years and spent from £500 to £5,000 per course. All of those courses were only presenting strategies that we had to follow, but without the opportunity to try them out live as the courses were conducted at weekends. To say that I have not learnt a few things from those courses would be incorrect, but in comparison to what I have learnt from Financial eLearning was phenomenal."

George Harrison

“The format of the course is clear, concise and has some great interactive sections. The click-a-long options allow students to go at their own speed and the handy exercises at the end prompt note taking and extra revision, which is brilliant. Full of step by step facts and easily readable text. From a tutor perspective I can work alongside the platform when checking the statistics and the progression of each student. It allows me to monitor this and support where necessary. Overall a great, simplistic and yet informative online course.”

Katie Prescott

“I recently did the course on how to maintain personal well-being. I found the course very helpful and learnt a lot about the different types of ways our wellbeing can be maintained. The platform was easy to use and had clear information on what to do. Thank you.”

Lucius Freud

“I have attended more than half a dozen trading training courses over the last four years and spent from £500 to £5,000 per course. All of those courses were only presenting strategies that we had to follow, but without the opportunity to try them out live as the courses were conducted at weekends. To say that I have not learnt a few things from those courses would be incorrect, but in comparison to what I have learnt from Financial eLearning was phenomenal. At last I have found a real course designed by experienced traders. This amazing course does not only teach you in depth the theory, but above all explains and demonstrates how to put it in practice. This allows you to learn how to trade the markets from the open to the close. If you are serious about becoming a trader, then this course is head-and-shoulders above the rest of the trading courses being offered to the retail traders.”

Stacey Robertson

“I had very little knowledge on what it meant to be a futures trader, but soon after joining the course it wasn’t long until I found myself immersed in the markets! Also, as someone with no background in trading or economics, I felt that the course accommodated for this with a level of teaching that was tailored for my needs. Overall, this experience has helped me turn my interest in trading into a reality.”

Our partners

We are fortunate to work with some of the biggest names in our industry.

100% Accessibility

100% Accessibility